owner draw vs retained earnings

Owners Equity Vs Retained Earnings. There are two main ways to pay yourself.

The Statement Of Stockholders Equity Youtube

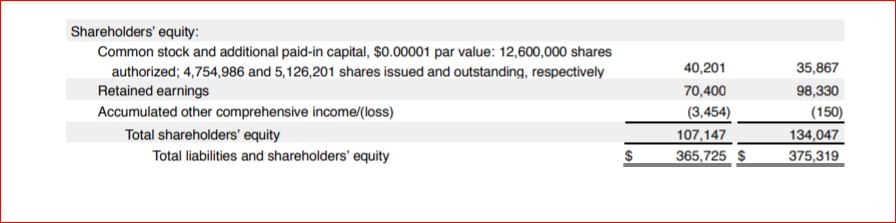

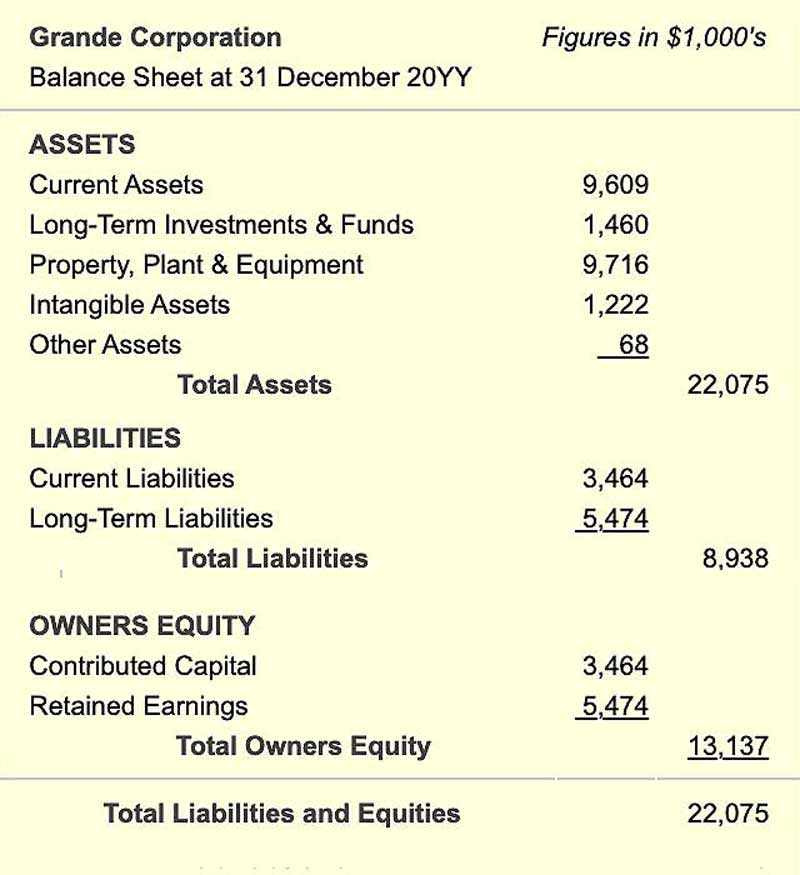

Retained earnings may play an important role in your businesss ability to fund.

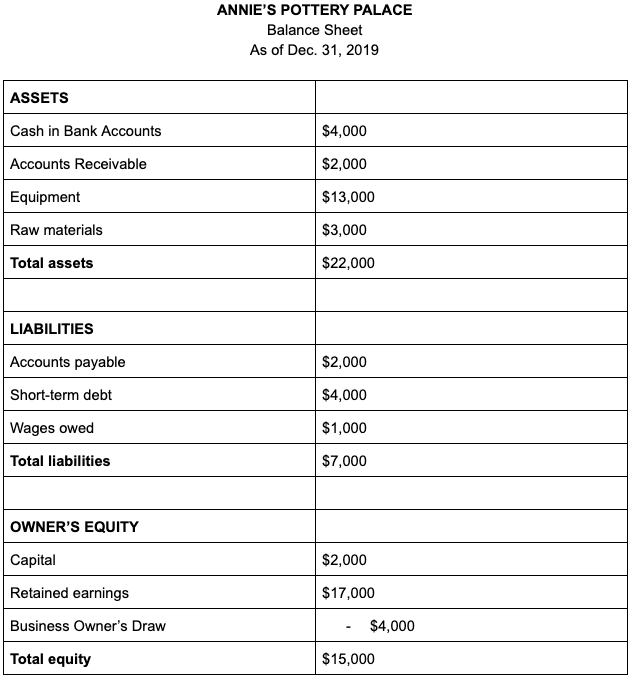

. A sole proprietor does not keep a separate account for retained earnings since he doesnt pay dividends out to shareholders or partners. At the time of the distribution of funds to an owner debit the Owners Drawing account and credit the Cash in Bank account. Owners draws can be scheduled at regular intervals or taken only.

An owners draw is an amount of money an owner takes out of a business usually by writing a check. Owners equity and retained earnings both measure the value of the company but they use different calculations to arrive at the value. Say for example that Patty has accumulated a 120000 owner equity balance in Riverside Catering.

It means owners can draw out of profits or retained earnings of a business. Dividends are paid out of the profits and reserves of a company. The draw method and the salary method.

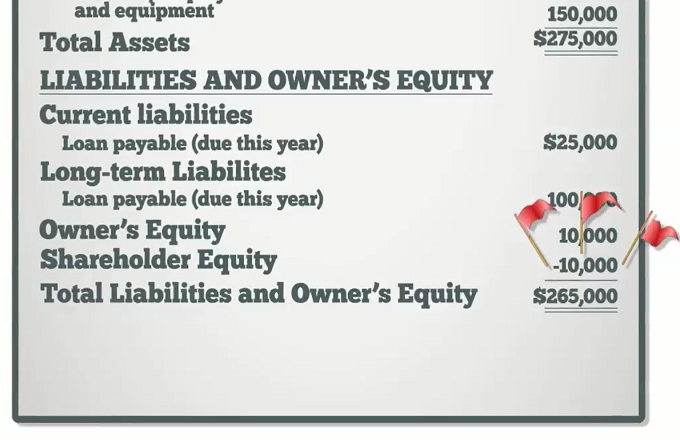

In other words retained. Often directors and owners draw more funds than accumulated retained earnings hence the equity. An owner of a sole.

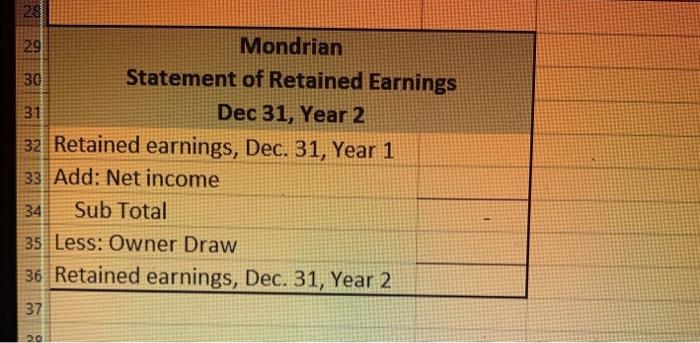

The business would record. Beginning RE of 5000 when the reporting period started. Retained earnings refer to the percentage of net earnings not paid out as dividends but retained by the company to be reinvested in its core business or to pay debt.

Statement of equity and. Retained earnings are profits or earnings of the business that have been kept for business use and not distributed to the owners or stockholders. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

The Draw acct should be zeroed out to Owners Capital Sole Pro or Retained Earnings Corp at the end of each accounting period - a calendar or fiscal year - which ever. It can decrease if the owner takes money out of the business by taking a draw for example. Revenue is the income earned from selling goods or services produced.

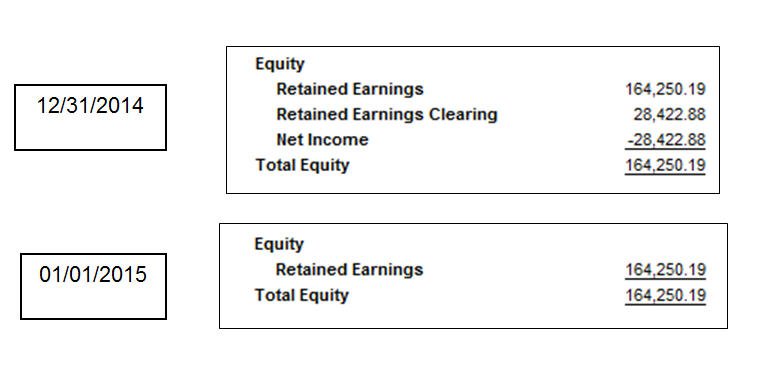

The best practice is to close opening balance equity accounts off to retained earnings or. It creates a negative drawings impact on the business. How do you close out owners draw to Retained Earnings.

Retained earnings make up part of the stockholders equity on the balance sheet. August 11 2020 by Walter Chen Leave a Comment. An owners draw is an amount of money an owner takes out of a business usually by writing a check.

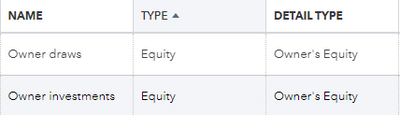

There are two journal entries for Owners Drawing account. Owners Contributions is the account similar to common stock used to represent a direct investment by the owner not accumulated earnings. A draw lowers the owners equity in the business.

Kryppla 7 yr. The owner still must keep track of his. With the draw method you can draw money from your business earning earnings as you see.

What Does Negative Shareholders Equity Mean

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Retained Earnings Why Companies Retain Their Profits Getmoneyrich

Balance Sheet Long Term Liabilities Accountingcoach

How To Create A Statement Of Retained Earnings For A Financial Presentation

Statement Of Owner S Equity Formula And Calculator Step By Step

How To Read A Balance Sheet Bench Accounting

Solved Mondrian Company Show The Following Balances Prepare Chegg Com

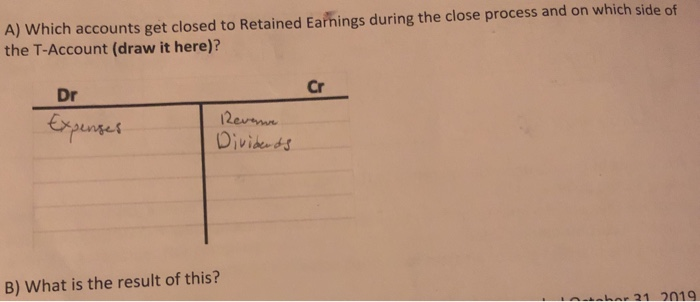

Solved A Which Accounts Get Closed To Retained Earnings Chegg Com

What Are Retained Earnings Definition Formula And Calculation Cfajournal

What Are Retained Earnings And How To Calculate Them Quickbooks Uk

Owners Equity Net Worth And Balance Sheet Book Value Explained

How To Create A Statement Of Retained Earnings For A Financial Presentation

Retained Earnings On The Balance Sheet Meaning Examples

Solved How To Close Out Owner S Draw And Owner S Investment For A Sole Proprietorship

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

True Joe Ways Retained Earnings Clearing Account Insightfulaccountant Com

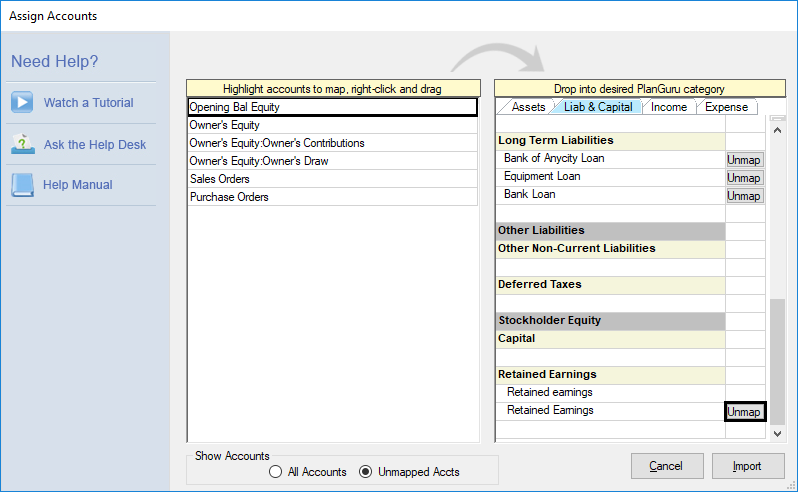

Capital Accounts Are Automatically Mapping To Retained Earnings During Qb Import